Mortgage rates: what you need to know now

Anúncios

Mortgage rates are determined by economic conditions, inflation, Federal Reserve policies, and individual credit scores, significantly impacting borrowers’ costs and overall home financing decisions.

The world of mortgage rates can feel overwhelming. With so many variables, how can you navigate the complexities to make informed decisions? Let’s dive into the key aspects you should consider.

Anúncios

Understanding mortgage rates

Understanding mortgage rates is essential for anyone looking to finance a home. Rates can change daily, and knowing how they work can save you a lot of money. There are many factors influencing these rates, and a clear grasp of them can give you an advantage in the housing market.

What are mortgage rates?

Mortgage rates are the interest rates charged on a mortgage. They can be fixed or variable, with each having its benefits. A fixed mortgage rate remains the same throughout the term, while a variable rate can change based on market conditions. It’s important to choose what fits your financial situation best.

Factors that influence mortgage rates

Several elements determine mortgage rates:

Anúncios

- Economic indicators: The economy’s health impacts rates significantly.

- Inflation rates: Higher inflation often leads to higher mortgage rates.

- Federal Reserve policies: Decisions made by the Federal Reserve can influence overall rates.

- Credit score: A better credit score can help you secure a lower interest rate.

Keeping an eye on these factors can empower buyers. When rates go down, it’s a great opportunity to refinance your existing mortgage to save on payments. Understanding the market can help you time your mortgage application perfectly.

Your lender will look at your financial situation, credit score, and the loan type to determine the rate you’re offered. A good practice is to shop around with different lenders to see who can offer you the best deal. By comparing rates, you can ensure that you get a mortgage that fits your financial goals.

Tips for managing your mortgage rates

To effectively manage your mortgage rates:

- Improve your credit: Pay down debt and avoid late payments.

- Consider a larger down payment: This can lower your rate.

- Lock in a rate: If you find a good rate, locking it in can help avoid potential increases.

- Keep an eye on the market: Awareness of market shifts helps you make informed decisions.

By following these tips, you can not only secure a better rate but also save significantly over the life of your loan. The journey to understanding mortgage rates can be simplified with a little research and preparation.

Factors influencing mortgage rates

Knowing the factors influencing mortgage rates is crucial for making informed decisions when buying a home. These rates are not set in stone; they can vary based on multiple economic and personal factors. Understanding these influences allows you to take better control of your mortgage costs.

Economic Conditions

The state of the economy plays a significant role in determining mortgage rates. When the economy is strong, with increasing jobs and income levels, demand for loans rises. This often leads to higher rates. Conversely, during economic downturns, mortgage rates tend to drop to encourage borrowing.

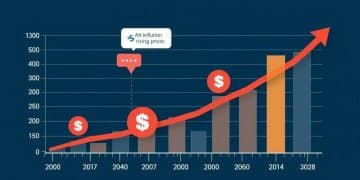

Inflation

Inflation can greatly affect mortgage rates. When inflation increases, the purchasing power of money declines. Lenders will typically raise mortgage rates to maintain their profit margins. As a borrower, being aware of inflation trends can help you predict potential changes in mortgage costs.

Federal Reserve Policies

The Federal Reserve, often referred to as the Fed, influences mortgage rates through its monetary policy. When the Fed raises interest rates, mortgage rates generally follow suit. Keeping an eye on Fed announcements is wise for anyone looking to secure a loan.

Credit Score

Your credit score is a significant factor in determining the rate you qualify for. A higher score generally leads to lower mortgage rates. Lenders view individuals with strong credit histories as less risky to lend to. Thus, maintaining a good credit score is essential.

Other personal factors, such as your income, debt-to-income ratio, and the size of your down payment, also come into play. The larger your down payment, the less risk you present to lenders, which may result in a lower interest rate. Each of these elements combines to create your unique mortgage rate.

By grasping these factors, you can better prepare yourself for when you apply for a mortgage. Knowledge is power, and understanding how rates are influenced can help you secure more favorable lending terms.

Tips for securing the best mortgage rate

Securing the best mortgage rate can significantly impact your financial future. By understanding key tips, you can navigate the market and find favorable terms that suit your budget. It’s crucial to be proactive and informed as you prepare for your mortgage application.

Improve Your Credit Score

Your credit score is one of the primary factors lenders consider when determining your mortgage rate. A higher score typically results in a lower rate. To boost your credit score:

- Pay off outstanding debts: Reducing your debt helps improve your score.

- Make payments on time: Consistent payments demonstrate reliability.

- Avoid new credit inquiries: Too many inquiries can lower your score.

Working on these elements can enhance your chances of securing a lower rate.

Shop Around

Don’t settle for the first offer you receive. Different lenders may provide different rates and terms. When shopping for a mortgage, consider:

- Checking multiple lenders: Compare interest rates and fees.

- Negotiating rates: Don’t hesitate to discuss rates with lenders.

- Considering credit unions: They often have lower rates than traditional banks.

Taking the time to compare options can pay off in the long run.

Consider the Loan Type

Choosing the right mortgage type is essential for securing a favorable rate. Options include fixed-rate mortgages, adjustable-rate mortgages (ARMs), and others. Each has its pros and cons. A fixed-rate mortgage offers stability, while an ARM might start with a lower rate. Understanding your long-term plans can help you make the best choice.

Make a Larger Down Payment

The size of your down payment can also affect your mortgage rate. Typically, a larger down payment means less risk for lenders. This can lead to better rates. Aim for at least 20% if possible, as this may eliminate private mortgage insurance (PMI) and lower your monthly payments.

Ultimately, securing the best mortgage rate involves preparation and knowledge. By improving your credit, shopping around, choosing the right loan type, and making a larger down payment, you’re setting yourself up for potential savings.

Future trends in mortgage rates

Future trends in mortgage rates can have a significant impact on the housing market and individual buyers. As economic conditions change, various factors will shape where rates are headed. It’s essential to stay informed about these trends to make smart financial decisions.

Economic Forecasts

One of the primary influences on mortgage rates is the overall economy. When the economy is growing, rates might rise. Conversely, during economic slowdowns, rates often drop as lenders compete for customers. Keeping an eye on economic forecasts helps you understand potential rate movements.

Interest Rate Policies

The Federal Reserve’s interest rate policies can also shape mortgage rates. If the Fed raises rates to curb inflation, mortgage rates typically follow. Alternatively, if rates drop, borrowers may find favorable conditions for financing. It’s essential to stay updated on the Fed’s decisions.

Technological Improvements

Technology is changing the mortgage landscape. Online lending platforms and automation streamline the application process, making it faster and more efficient. These advancements can reduce costs for lenders and potentially lead to lower rates for borrowers.

Demographic Shifts

Demographic trends, such as the aging population and millennials entering the housing market, will influence the demand for mortgages. Changes in buyer preferences can impact rates as lenders adjust to meet the needs of new borrowers. For example, a high demand for homes among younger buyers may drive rates down if service competition increases.

As you look to the future, understanding these trends in mortgage rates will equip you to make informed decisions. Monitoring economic conditions, interest rate policies, technological changes, and demographic shifts can provide insights into how the market may evolve.

FAQ – Frequently Asked Questions about Mortgage Rates

What factors influence mortgage rates?

Mortgage rates are influenced by economic conditions, inflation, Federal Reserve policies, and individual credit scores.

How can I improve my credit score before applying for a mortgage?

To improve your credit score, pay off debts, make all payments on time, and avoid applying for new credit.

Is it necessary to shop around for mortgage rates?

Yes, shopping around allows you to compare rates and terms from different lenders, potentially saving you money.

What should I consider when choosing the type of mortgage?

Consider factors such as the stability of fixed rates versus the potential lower initial rates of adjustable-rate mortgages.