April 2025 financial volatility prompts investor concern

Anúncios

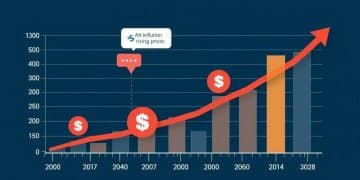

April 2025 financial volatility prompts investor concern due to fluctuating economic indicators, geopolitical events, and market speculation, which necessitate diversified portfolios and proactive strategies for long-term success.

April 2025 financial volatility prompts investor concern as market fluctuations raise eyebrows. Many are left questioning how these changes affect their investments. Are you prepared for what’s next?

Anúncios

Understanding the causes of April 2025 financial volatility

Understanding the causes of April 2025 financial volatility is crucial for investors navigating these uncertain times. Several factors contribute to fluctuations in the market.

Economic Indicators

Economic indicators play a significant role in influencing market trends. When key metrics shift, they can lead to changes in investor sentiment. These indicators include:

Anúncios

- Gross Domestic Product (GDP)

- Unemployment rates

- Inflation rates

- Consumer confidence index

As these factors fluctuate, they can cause uncertainty, leading to volatility. For instance, rising inflation might prompt the Federal Reserve to adjust interest rates, which can scare off investors.

Geopolitical Events

Geopolitical tensions can also create instability in financial markets. Wars, trade negotiations, and political unrest can have a sudden impact on investor behavior. For example, recent conflicts have led to spikes in oil prices, increasing operational costs for many companies.

Supply chain disruptions have repeatedly emerged as a major concern, directly affecting profitability and market stability. When supply chains are disrupted, businesses struggle to meet demand, causing stock prices to drop.

Market Speculation

Another cause of financial volatility is market speculation. Investors often react to rumors or forecasted changes, causing markets to swing wildly. This speculation can create a bubble effect, where prices inflate without justified value.

As these speculative trends continue, they can lead to rapid sell-offs, further increasing volatility and uncertainty in the markets. Monitoring social media and financial news can help investors gauge sentiment and make informed decisions.

Finally, technological advancements have contributed to quicker trading processes. Automated trading systems allow investors to execute trades in milliseconds, amplifying price changes and market fluctuations.

In summary, the interplay of economic indicators, geopolitical events, and market speculation creates a complex environment of financial volatility. Investors need to stay informed and adaptable in these unpredictable circumstances.

Impact of economic indicators on investor confidence

The impact of economic indicators on investor confidence is profound. Investors closely watch these indicators to gauge the health of the economy. Key indicators can significantly influence decision-making.

Types of Economic Indicators

There are three main types of economic indicators: leading, lagging, and coincident. Each type provides different insights into the economy.

- Leading indicators: These predict future economic movements, like stock market performance.

- Lagging indicators: These reflect past performance, such as unemployment rates.

- Coincident indicators: These move with the economy, like GDP.

Leading indicators are particularly important for investors as they signal potential changes before they happen.

Investor Reactions

Investors react to economic indicators in various ways. When positive indicators, like low unemployment rates, are released, investor confidence generally rises. This leads to increased investments in stocks and other assets.

Conversely, negative indicators, such as rising inflation, can cause panic. When investors see high inflation, they may sell off investments, fearing reduced purchasing power. These reactions can create swift market reactions, resulting in heightened volatility.

Moreover, economic indicators can also influence the stock market on a broader scale. For instance, indicators like consumer spending and business investment levels can determine market trends. When these indicators show strength, they can buoy the market. However, sluggish indicators can pull it down.

Monitoring Economic Indicators

Monitoring these indicators becomes vital for strategic investing. Many investors rely on economic reports released monthly or quarterly. Staying updated with these reports allows investors to make informed decisions.

Popular sources of economic data include government agencies, financial news outlets, and investment platforms. The more informed investors are about economic trends, the better their investment choices become. Thus, tracking these indicators is essential for navigating financial volatility.

Strategies to navigate financial uncertainty

Developing effective strategies to navigate financial uncertainty is essential for investors. In unpredictable markets, having a clear plan can help minimize risks. Below are some strategies to consider.

Diversification

Diversification remains a fundamental strategy. By spreading investments across various asset classes, such as stocks, bonds, and real estate, investors can reduce exposure to any single investment. This strategy helps balance potential losses with gains in other areas.

For example, if stocks are underperforming, bonds or real estate might provide the needed stability. Investors should regularly review their portfolios to ensure they are adequately diversified.

Stay Informed

Staying informed about market trends and economic indicators is crucial. Regularly monitoring financial news can aid in anticipating market shifts. Investors should consider subscribing to reliable sources of information.

- Financial news websites

- Investment analysis platforms

- Government economic reports

- Market analysis podcasts

Being informed empowers investors to make timely decisions, potentially mitigating losses before they escalate.

Set Realistic Goals

Establishing realistic investment goals is another key strategy. Investors should determine their risk tolerance and financial objectives. Setting clear goals helps in making informed choices that align with personal financial situations.

For instance, an investor saving for retirement might choose lower-risk investments as they near retirement age. This gradual shift helps protect their savings from sudden market downturns.

Consulting Professionals

Finally, seeking the advice of financial professionals can provide valuable insights. Financial advisors can offer personalized recommendations based on individual circumstances. They can help develop comprehensive financial plans addressing specific concerns of uncertainty.

A professional can also assist in adjusting strategies as market conditions change. By combining personal research with expert guidance, investors can better navigate the complexities of financial markets.

Long-term implications for investment portfolios

Considering the long-term implications for investment portfolios is essential for any investor. Changes in financial markets can significantly impact existing portfolios and future investment strategies.

Portfolio Diversification

One critical aspect to maintain is diversification. A well-diversified portfolio can help mitigate risks associated with market downturns. By spreading investments across various asset classes, such as stocks, bonds, and real estate, investors can cushion against volatility.

- Equities: Invest in a mix of sectors for exposure to growth.

- Bonds: Include government and corporate bonds for stability.

- Real Estate: Consider real estate investments for income generation.

- Cash Equivalents: Keep some funds liquid for emergencies or opportunities.

This mix can provide returns even when some sectors struggle.

Rebalancing Strategies

Regular rebalancing is also key. As markets fluctuate, the initial asset allocation can drift from its intended targets. Annual or semi-annual rebalancing helps maintain the desired risk level.

During rebalancing, investors adjust their holdings back to the original allocation. For instance, if equities performed well, they might comprise a larger percentage of the portfolio than planned. Selling some equity positions can allow for buying underperformers, helping to maintain balance.

Impact of Economic Conditions

The performance of portfolios can also be affected by macroeconomic conditions. Factors such as interest rates, inflation, and geopolitical tensions can influence asset prices. For example, when inflation rises, the purchasing power of consumers typically falls, impacting company profits and stock performances.

By keeping an eye on these economic indicators, investors can adjust their strategies according to market conditions. This proactive approach helps in safeguarding investments against adverse effects.

Long-term Goals and Adjustments

Investors should always keep their long-term goals in mind. Whether saving for retirement, funding education, or achieving financial independence, aligning the investment strategy with these goals is crucial. As life circumstances change, it may be necessary to adjust the portfolio accordingly.

This adaptability ensures that the investment strategy remains relevant in the face of changing personal or economic conditions, enhancing the potential for achieving financial objectives.

Conclusion: Understanding the long-term implications for investment portfolios is essential in today’s financial landscape. By diversifying investments, regularly rebalancing, monitoring economic conditions, and aligning strategies with personal goals, investors can navigate uncertainties effectively. Emphasizing proactive management and adapting to changes will create stronger portfolios and enhance the potential for achieving financial success.

FAQ – Frequently Asked Questions about Long-term Investment Strategies

What is portfolio diversification?

Portfolio diversification involves spreading investments across different asset classes to reduce risk, ensuring that poor performance in one area doesn’t heavily impact overall returns.

How often should I rebalance my investment portfolio?

It’s recommended to rebalance your portfolio at least annually or whenever your asset allocation drifts significantly from your target percentages.

Why are economic indicators important for my investments?

Economic indicators provide insights into market trends and conditions, helping investors make informed decisions about buying, holding, or selling assets.

When should I consider consulting a financial advisor?

You should consider consulting a financial advisor when you’re unsure about your investment strategy, experience significant life changes, or need expert guidance on complex financial matters.